The following analysis of the Central Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Regional Economic Overview

The Central Washington region lost more than 12,500 jobs due to COVID-19, but, as I reported in the third quarter Gardner Report, almost all of them had returned. Unfortunately, a resurgence in new COVID-19 cases has again led to job losses. Employment levels are more than 4,600 jobs lower than before the pandemic started. Something to note is that the state’s economist advised me that the sample used for the October numbers was inferior to prior months and is likely causing an overestimation of job losses. I expect to see better numbers, but only when re-benchmarking occurs in March. With this caveat in mind, the unemployment rate, which peaked at 14.9%, has dropped to 7.3%. Again, this may be higher than is actually the case. In general, jobs are returning but—regardless of data discrepancies—I still anticipate we will see a slowdown in the pace of job growth. This will likely not improve significantly until a vaccine for COVID-19 is freely available.

central washington Home Sales

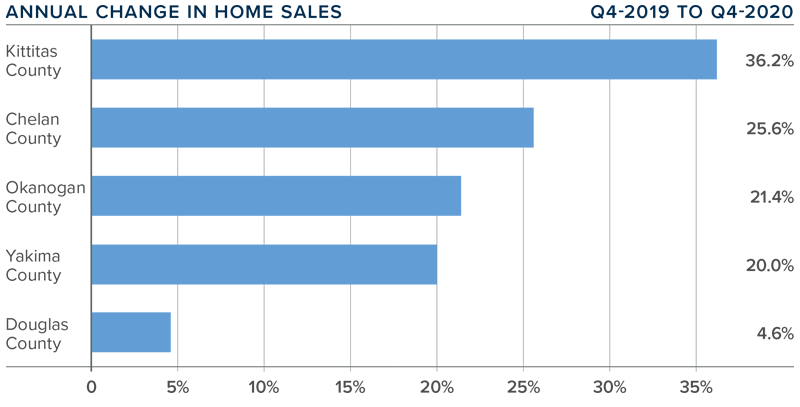

❱ Home sales in Central Washington were up an impressive 22.5% compared to the same quarter in 2019, with a total of 1,517 transactions taking place.

❱ Pending home sales in the region were 39.2% lower than in the third quarter, but this can be attributed to seasonality and a significant lack of inventory.

❱ Sales activity rose in all counties contained in this report, with significant increases everywhere except Douglas County, though even that market saw sales rise. Compared to the third quarter of 2020, sales in Central Washington were a remarkable 37.7% higher.

❱ The average number of homes for sale in the quarter was 45.8% lower than a year ago, and 30.2% lower than in the third quarter of 2020. Inventory levels remain well below historic averages.

central washington Home Prices

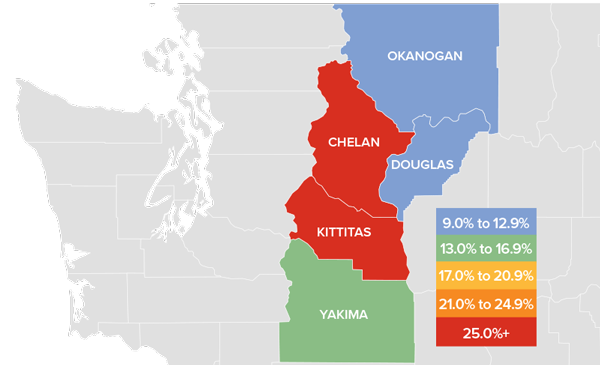

❱ Year-over-year, the average home price in Central Washington rose a substantial 26% to $443,870. Prices were also 6.4% higher than in the third quarter of 2020.

❱ Low inventory levels remain pervasive, which is clearly driving prices higher as demand far exceeds supply. I expect the number of homes for sale to rise in 2021, but the question remains whether there will be enough listings to meet demand.

❱ All but one county covered in this report saw home prices increase by double-digits. Kittitas County experienced very significant growth.

❱ The takeaway is that average home-price growth in Central Washington remains well above the long-term average and is unlikely to slow down until we see a significant increase in inventory levels.

Days on Market

❱ The average time it took to sell a home in Central Washington in the final quarter of 2020 was 49 days.

❱ During the fourth quarter, it took 20 fewer days to sell a home in Central Washington than it did a year ago.

❱ All counties saw the length of time it took to sell a home drop compared to a year ago. Okanogan and Kittitas counties experienced significant drops.

❱ It took eight fewer days to sell a home in the fourth quarter of 2020 than it did in the third.

Conclusions

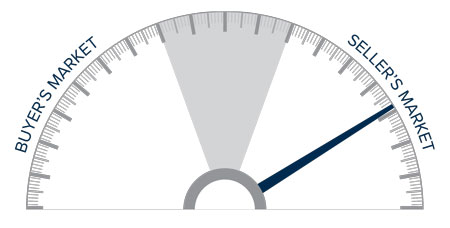

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link