The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Regional Economic Overview

Along with the rest of the country, the Idaho economy and its employment levels were significantly impacted by COVID-19. Though 83,100 jobs were lost, the recovery continues, with all but 3,400 of the jobs lost having returned. With this recovery in employment, the unemployment rate, which peaked at 11.8% in April, now stands at a respectable 4.8%. Although the direction is very positive, I am continuing to temper my enthusiasm because Idaho saw new COVID-19 cases rise in December. If this continues, the pace of the job recovery may slow.

idaho Home Sales

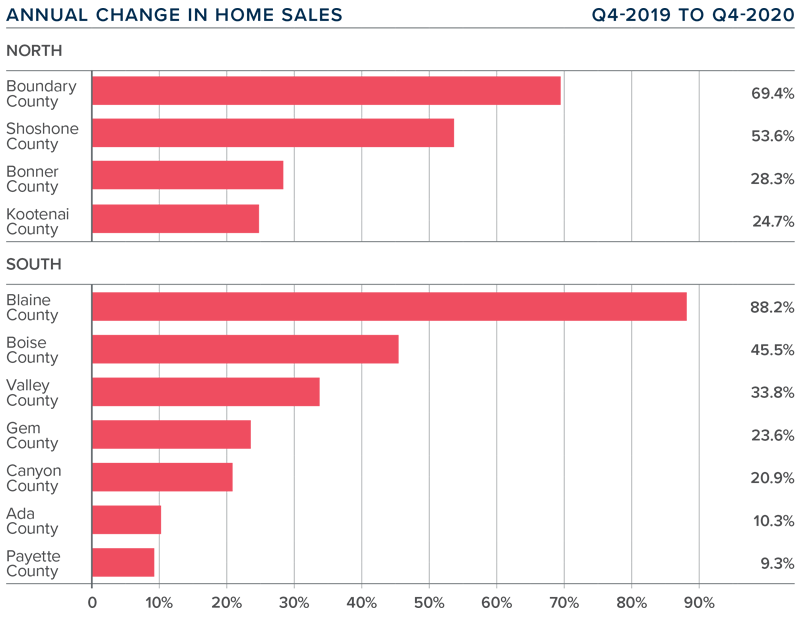

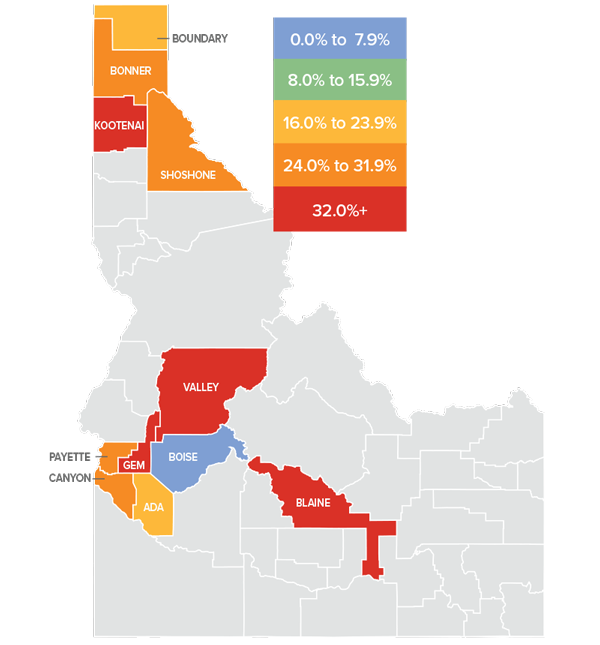

❱ During the final quarter of 2020, 7,282 homes were sold. This represents a very significant year-over-year increase of 19.4%.

❱ In the southern markets, sales also rose in all counties. Blaine County saw a remarkable increase: the number of transactions there was up 88%. Double-digit growth was seen in all counties other than Payette.

❱ Year-over-year sales growth was positive in all the Northern Idaho counties contained in this report. Boundary County saw significant growth. Overall, the region saw double-digit growth.

❱ Pending sales slowed compared to the third quarter, but I attribute this to seasonality. Listing activity was 50% lower than in the fourth quarter of 2019, which certainly frustrated would-be buyers.

idaho Home Prices

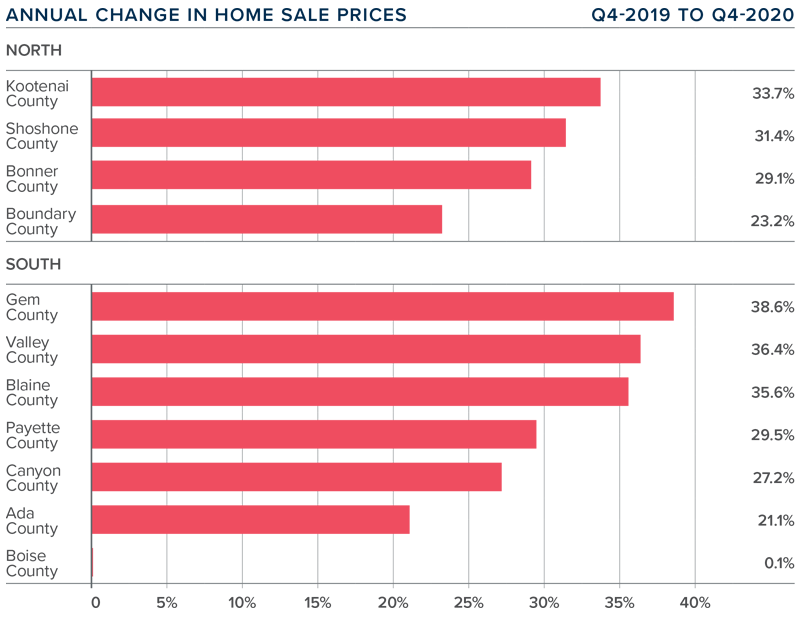

❱ The average home price in the region rose a very significant 29% year-over-year to $496,679.

❱ In Northern Idaho, prices rose significantly in Kootenai County, but all counties saw double-digit gains. Southern Idaho price growth was equally impressive, with Blaine County standing out with an average home sale price over $1.2 million.

❱ Prices rose in all Northern and Southern Idaho counties covered by this report.

❱ As mentioned above, inventory levels remain an issue. As much as I would like to say they will increase early in the spring, I am afraid that may not be the case.

Days on Market

❱ It took an average of 100 days to sell a home in Northern Idaho, and 45 days in the southern part of the state covered by this report.

❱ The average number of days it took to sell a home in the region dropped ten days compared to the fourth quarter of 2019.

❱ In Northern Idaho, days on market dropped in all counties other than Shoshone, where market time rose by 19 days. In Southern Idaho, market time dropped in all counties other than Blaine, where it took 25 more days to sell a home than in the final quarter of 2019.

❱ Homes sold fastest in Canyon and Ada counties in the southern part of the State. Sales were fastest in Boundary County in the northern part of the state.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand for housing remains strong, and sales are only being limited by the lack of homes on the market. The economy continues to improve, and buyers are still very active. The only thing missing are more homes to buy, which has led prices to rise very significantly. With buyer demand continuing to far exceed supply, I am moving the needle more in favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link